Search

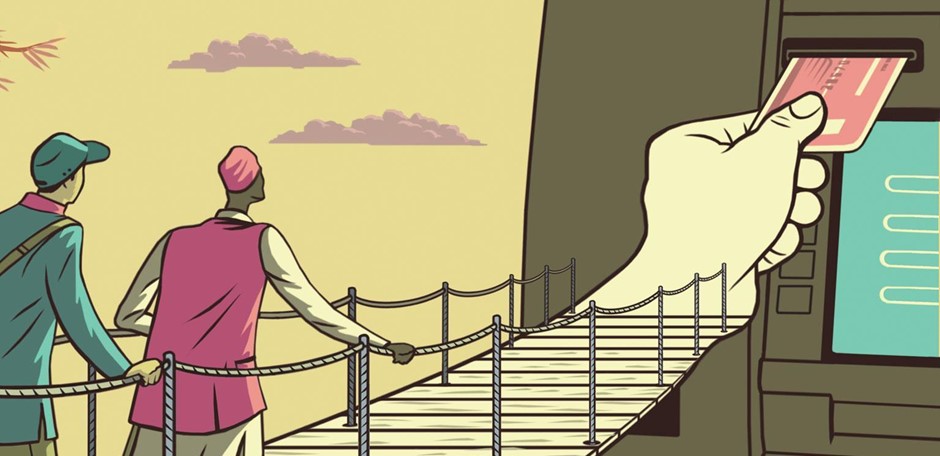

What’s Financial Inclusion? What’s its Significance in India?

November 23, 2017

Financial inclusion can be defined as an effort to provide affordable financial services and credit to the weaker sections and low-income groups of the society. It’s not limited to merely banking products but other financial services such as equity and insurance products as well.

What are the benefits of financial inclusion?

- Individuals living in the rural areas will get access to modern banking services such as savings accounts, insurance, investment schemes like fixed deposits, mutual funds, etc.

- It will help building a cashless economy as more and more people will get to use digital payments services.

- It will encourage the people to save their money and put it into investment schemes which will help in the growth of the economy

- The beneficiaries of social welfare schemes will get the funds directly into their bank accounts. This will curb corruption and bring transparency in the system.

Where do we stand today?

As per the Assocham-EY joint report, India’s financial infrastructure is still inaccessible to a large number of poor people with more than 19% of the population either unbanked or financial excluded.

However, the report said that the central bank RBI is making concentrated efforts to improve financial inclusion. In that endeavor, many regional rural banks (RRBs) and cooperative banks have been launched, self-groups set up, and business correspondents appointed to provide door-step access to the financial services.

The following are some of the major steps taken by the government to support financial inclusion in the country:

JAN DHAN Accounts:

In 2005, the RBI had introduced “No Frills” bank accounts that could be maintained with low minimum balances. These were replaced by BSBDA (Basic Saving Bank Deposit Accounts) that offered additional benefits to the low-income groups. However, since bank banks didn’t implement the concept well, finally the government introduced JAN DHAN accounts. Individuals with these accounts get RUPAY debit card, free life insurance, and even an overdraft facility up to Rs. 5,000 per month.

Insurance Products:

Since insurance also plays an important role in financial inclusion, the government has introduced various schemes such as Pradhanmantri Fasal Bima Yojna and Pradhan Mantri Jeevan Jyoti Yojna for affordable crop insurance and life insurance respectively.

Special Banks:

Small finance banks and payments banks are two other concepts that are being encouraged by the government for financial inclusion.

Important Links:

Courses

-

MBA for Executives

-

testssd

-

testssd

-

testssd

-

testssd

-

testssd

-

BBA from UK University

-

Banking course + Job

-

MBA from ARU, Anglia Ruskin University (UK)

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

MBA from HSNC University (Mumbai, India)

-

Sage Foundation - Professional Diploma in Banking

-

3-in-1-management-program

-

Post Graduate Diploma in Banking & Finance

-

Post Graduate Diploma in Digital Marketing

-

Post Graduate Diploma in Integrated Marketing, Advertising & Communication

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

Professional Diploma in Digital Marketing

-

Professional Diploma in Real Estate Management

-

Professional Diploma in Photography

-

Certificate in Business English