Search

How to Spot a Fake GST Bill and GSTIN

September 25, 2017

It’s no secret that now shopping bills comprise of GST taxes instead of VAT, Service Tax, etc. However, some trickster businesses are trying to delude their customers by charging GST even when it’s not warranted or through a fake GSTIN. So, how do you find out if you are being duped?

Identifying a fake GST Bill and GSTIN

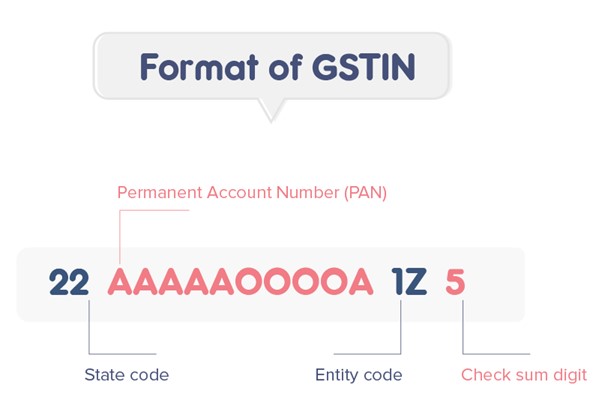

A GSTIN or GST Identification Number is a 15-digit unique number provided to a business that’s registered under the GST taxation system. It’s based on the business entity’s PAN and their state. Its format is as follows:

- The first two digits are the state code. So, you can check if the location of the business is in line with the first two digits of their GSTIN with the following coding system:

01-Jammu and Kashmir, 02-Himachal Pradesh, 03-Punjab, 04-Chandigarh, 05-Uttarakhand, 06-Haryana, 07-Delhi, 08-Rajasthan, 09-UP, 10-Bihar, 11-Sikkim, 12-Arunachal Pradesh, 13-Nagaland, 14-Manipur, 15-Mizoram, 16-Tripura, 17-Meghalaya, 18-Assam, 19-West Bengal, 20-Jharkhand, 21-Orissa, 22-Chattisgarh, 23-MP, 24-Gujarat, 25-Daman and Diu, 26-Dadar and Nagar Haveli, 27-Maharashtra, 28-Andhra Pradesh, 29-Karnataka, 30-Goa, 31-Lakshadweep, 32-Kerala, 33-Tamil Nadu, 34-Puducherry and 35-Andaman and Nicobar Islands. - The 10 digits following the state code are the PAN number of the business.

- The number immediately following the PAN is the total number of registrations the business has within the state. For instance, if a taxpayer has two separate businesses in the same state and under the same PAN, then this number will be 2. After the number 9 is reached, the series is followed in alphabetic order. So, a business with 10 registrations will have the letter A in this position, B for 11 registrations, and so on.

- The 14th digit will have the default value of Z and the 15th digit is used by the authority for checking errors.

You can verify these details with the GSTIN printed on your restaurant/store bill to check if it’s authentic.

However, if you want to find out for sure, you can follow these steps:

- Go to https://services.gst.gov.in/services/searchtp

- Enter the GSTIN in the appropriate field and click “Search”

- It will display all the details of the business. However, if it’s a fake number then it won’t display any details.

If you find out that a business is charging you with a fake GSTIN, then you can inform the authority through the following:

Email: helpdesk@gst.gov.in

Phone: 0120-4888999, 011-23370115

Important Links:

Courses

-

MBA for Executives

-

testssd

-

testssd

-

testssd

-

testssd

-

testssd

-

BBA from UK University

-

Banking course + Job

-

MBA from ARU, Anglia Ruskin University (UK)

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

MBA from HSNC University (Mumbai, India)

-

Sage Foundation - Professional Diploma in Banking

-

3-in-1-management-program

-

Post Graduate Diploma in Banking & Finance

-

Post Graduate Diploma in Digital Marketing

-

Post Graduate Diploma in Integrated Marketing, Advertising & Communication

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

Professional Diploma in Digital Marketing

-

Professional Diploma in Real Estate Management

-

Professional Diploma in Photography

-

Certificate in Business English