Search

P2P Lending: Working, and RBI Regulations

October 16, 2017

Peer to Peer lending, more commonly known as P2P lending, entered the Indian market a long time ago. However, it has assumed great significance in the country only recently. The fact that RBI has decided to regulate the P2P NBFC industry, is just an attestment to the same.

P2P Lending Explained

Traditionally, when an individual or a businessman needed a loan, they had limited options. They could either borrow the money from their family or approach their bank for the same. However, P2P lending has changed the picture today.

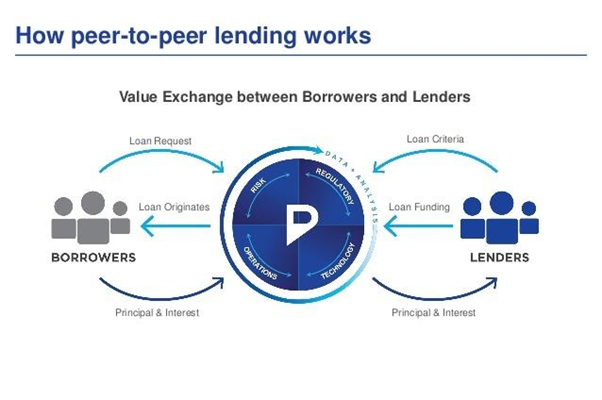

In P2P lending, there are no multinational banks or large corporations. Instead, the funds are provided by individuals directly in a simple manner with few third-parties.

So, a P2P platform is just an online platform that connects the lenders to the borrowers in a more transparent manner.

If you want a P2P loan, then you can take the following steps:

- Pick a P2P platform and register as a borrower on that. In most cases, you will need to provide your personal, professional, and financial details.

2.The platform will verify these details by asking for revenant documents.

- If your profile is approved, you can publish a listing and mention the loan amount and its purpose.

- The lenders will assess your creditworthiness. However, unlike traditional lenders, like banks, the process on P2P platforms is more forgiving and lenient.

- The lenders will offer an interest rate. If you agree, you can apply for the loan and learn about the terms and conditions.

RBI recently recognized P2P lending as NBFCs (Non-Banking Financial Companies). It has also issued regulations for them, which are:

- They must register with the RBI within 3 months.

- They cannot sell products save for loan specific insurance products

- They are required to carry out due diligence of their participants

- The maximum amount of loan they are permitted to disburse is Rs. 10 lakhs.

- They can transfer funds only through Escrow Account mechanism.

- They must submit quarterly statements to the RBI.

Note: Individuals, who want to earn money through interest can also register on most of the P2P platforms as lenders easily.

Important Links:

Tags:

FinanceCourses

-

MBA for Executives

-

testssd

-

testssd

-

testssd

-

testssd

-

testssd

-

BBA from UK University

-

Banking course + Job

-

MBA from ARU, Anglia Ruskin University (UK)

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

MBA from HSNC University (Mumbai, India)

-

Sage Foundation - Professional Diploma in Banking

-

3-in-1-management-program

-

Post Graduate Diploma in Banking & Finance

-

Post Graduate Diploma in Digital Marketing

-

Post Graduate Diploma in Integrated Marketing, Advertising & Communication

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

Professional Diploma in Digital Marketing

-

Professional Diploma in Real Estate Management

-

Professional Diploma in Photography

-

Certificate in Business English