Search

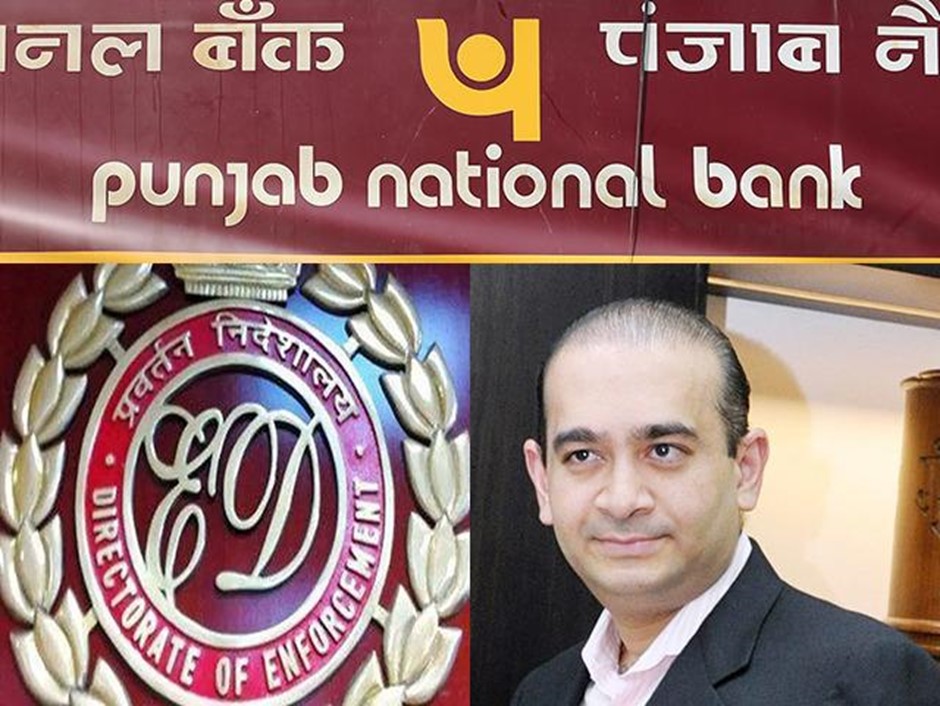

All You Need to Know About PNB Rs. 11,300 cr Nirav Modi Fraud

February 22, 2018

47-year old billionaire and owner of India’s one of the leading diamond jewellery houses, Nirav Modi is all over the news as of late because of the whopping Rs. 11,300 crore fraud that he was able to pull off with the Punjab National Bank (PNB).

Modi reportedly identified the loopholes in the banking system, in the letters of undertaking (LoU) issuance to be precise, which he used to his advantage. He would use them to raise credit from the foreign banks for his 3 businesses: Steller Diamonds, Solar Exports, and Diamond R Us.

The following points explain exactly how the fraud was committed.

- A letter of undertaking (LoU) is a type of bank guarantee that allows a customer to raise a short-term credit with a foreign branch of an Indian bank. A LoU involves an issuing bank, a receiving bank, a beneficiary located overseas, and an importer.

- When a customer wants to raise a LoU, they have to pay margin money to the bank. On the basis of that, the bank grants a credit limit. However, in the case of Modi, neither did he pay any margin money, nor did the bank set a credit limit.

- Modi was paying his raw stones suppliers with the payments issued by multiple banks including Allahabad Bank and Axis Bank on the basis of the loans raised via the LoUs with PNB.

- The scam unearthed in January this year when Modi sought to raise another LoU with PNB’s Brady Road branch in Mumbai. However, this time the bank said that he need to keep 100% collateral of his firm for the same. In response to that, his firm argued that there was no such requirement in the previous instances of the LoUs. So, the officials checked his records only to realize that there were no traces of the transactions. In other words- the LoUs were issued after breaching the rules by the employees of the bank itself.

- The suspect bank officials issued the LoUs and informed the foreign branches through SWIFT which is a network of the International banks. However, PNB had not integrated its SWIFT network with the bank’s core banking network. This is the reason why no one could trace the transactions made for Modi’s benefit.

Important Links:

Courses

-

MBA for Executives

-

testssd

-

testssd

-

testssd

-

testssd

-

testssd

-

BBA from UK University

-

Banking course + Job

-

MBA from ARU, Anglia Ruskin University (UK)

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

MBA from HSNC University (Mumbai, India)

-

Sage Foundation - Professional Diploma in Banking

-

3-in-1-management-program

-

Post Graduate Diploma in Banking & Finance

-

Post Graduate Diploma in Digital Marketing

-

Post Graduate Diploma in Integrated Marketing, Advertising & Communication

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

Professional Diploma in Digital Marketing

-

Professional Diploma in Real Estate Management

-

Professional Diploma in Photography

-

Certificate in Business English