Search

Hashtag Investing Top 10 Best Options Strategies For Beginners To Use In 2023

February 09, 2022

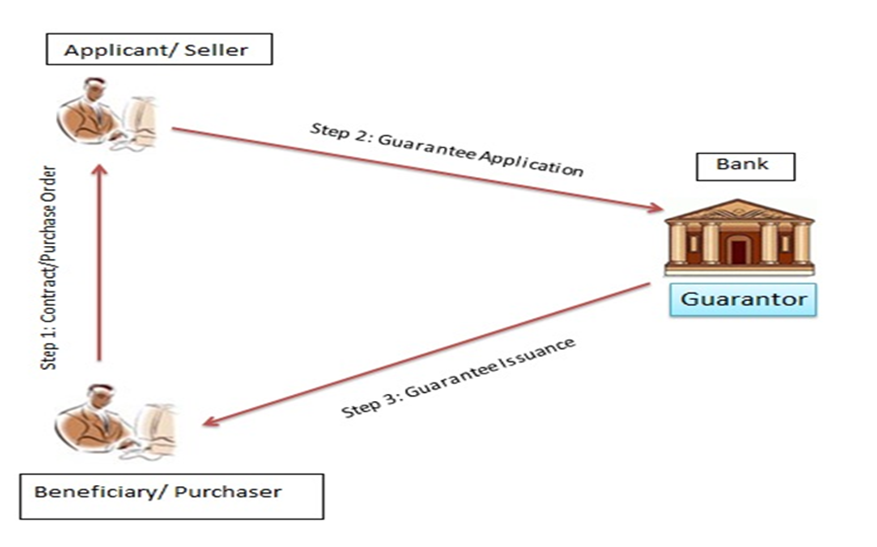

A vertical options trade consists of 2 legs, similar to the diagonal spread. You go long an option and short an option with different strikes. That is the key difference between a vertical as well as a diagonal spread.

The difference between the premiums paid and received is the net debit. The strategy involves buying put options of the stock that we are holding and on which we have a bullish view. If the price of the underlying rises, then we shall make profits whereas if the price falls then the loss will be limited to the premium that is paid for the put option.

A long straddle can only lose a maximum of what you paid for it. Since it involves two options, however, it will cost more than either a call or put by itself. The table shows that the cost of protection increases with the level thereof. However, if the trader is willing to tolerate some level of downside risk, choosing a less costly out-of-the-money option such as the $40 put could also work. In this case, the cost of the option position will be much lower at only $200. A put option works effectively in the exact opposite direction from the way a call option does, with the put option gaining value as the price of the underlying decreases.

- This might be a significant commitment and you will still be substantially exposed to a substantial fall in the underlying share price.

- Stock Trader explained that stop-loss orders should never be set above 5 percent .

- With so many different strategies to choose from, it can be difficult to know which one is the safest and most effective for your needs.

- But we also realize that the stock has had an incredible run as of late and want some downside protection, specifically over the short to intermediate term.

- Ideally, you should sell a short date-to-expiration call option, since time value decay is the fastest in the last 2-3 months of an option contract horizon.

Options are like tools that can help an investor buy stocks at the target buying price or sell stocks at the target selling price. There are two major types of options which include put and call options. Again, this is something that proponents of option selling will highlight time and again (a much higher probability to WIN even though the profit potential is much lower than the at-risk amount). How this is structured is generally purchasing a long call with a strike price that is lower than the strike price of the call you sold.

Is option selling safe?

Later, when the stock does rise in price, you’ll be even richer for using the covered call when the timing was right. Our March report reveals the 3 “Strong Buy” stocks that market-beating analysts predict will outperform over the next year. You’ve entered into an agreement to buy 100 shares of AAPL at $130 under any condition until expiration.

Put options are just one of the types of derivatives that Buffett deals with, and one that you might want to consider adding to your own investment arsenal. This position has limited upside, but it is very low-risk because you can make money if the market rises, stays flat, or even falls somewhat, and if the market crashes, your losses are limited. And also have a chance to get assigned on the stock, if the stock price is below your strike price at expiration. But the key reason to use the strategy is not about making additional returns, it’s about protecting profits. And through using a collar option strategy, in this instance, you are protected if AAPL falls below 150 .

It’s important to view options as a strategic investment and many people are making a living by selling options. The way we setup trades permits us to be profitable up to 98% of the time. In many cases, the time premium would serve me a lot better if it was allocated to reducing the size of the position or rolling to a more favorable strike price, instead of buying the long put option.

Risk/Reward

When picking stocks, individuals opting for this intraday trading strategy must ensure that they choose shares that are liquid as well as volatile. Furthermore, they must make sure to put in a stop loss for all orders. An investor who sells stock short and purchases a call is using a strategy that is risk-equivalent to buying a Put option.

If you want to sell Cash Secured Puts, then you want to sell them only during the right time. If the stock is below $100 at the expiration date, then your Put Option will get exercised. Each time safest option strategy they sell a Cash Secured Put and it expires worthless, they sell another one again. And now that the Put Option has expired, you can sell another Cash Secured Put and collect a premium again.

It is essential to keep in mind that both calls must have the same underlying stock and expiration date. This is why selling vertical put credit spread options is my favorite options trading strategy and trading options is the most successful options strategy and the best option strategy ever. A Synthetic Call is one of the bullish options strategies used by those traders who have a bullish view of the stock for the long term but are also worried about the downside risks at the same time. This strategy offers unlimited potential profits with limited risk.

A safe strategy is one that minimizes your exposure to risk while still providing the potential for significant profits. In other words, it’s a strategy that allows you to sleep well at night, knowing that your investments are in good hands. I always think the best approach is to only sell options on stocks you wouldn’t minding owning for a few years if you have to. Remember to think of covered calls as a strategy to get paid to take profit at a certain price.

Some of the most profitable and productive trading is accomplished through selling options for income. You can make money on the way up and on the way down, in any market. By selling options, you control all aspects of your capital, including risk outcomes on particular trades. It’s called box spread, i.e. you buy a call debit spread and sell a put credit spread of the same strikes. This strategy is often used by market makers who have some sorts of an edge.

Sign up to get daily digests on the stocks that matter to you.

Give me 3 minutes, and I’ll cover the 2 best options selling strategies and the best buying call options strategy. A protectivecollarstrategy is performed by purchasing anout-of-the-money put option and simultaneously writing an OTM call option when you already own the underlying asset. Another successful intraday trading strategy in India is the moving average crossover strategy. When the prices of stocks or any other financial instrument move above/below the moving average, it serves as an indication that there is a change in momentum.

Leverage, low levels of extrinsic value, massive upside, and limited risk – these stock-simulating contracts have it all. A covered call is selling a call on shares you already own – the shares act as the collateral. Spreads involve buying one options and simultaneously selling another option . Covered calls, collars, and married puts are used when you already have an existing position in the underlying shares. And regardless of the trend, as long as it moves, a profit and loss are produced. In a Long Straddle Options Strategy, a trader essentially purchases a long call and a long put.

A Complete Guide on Options Trading

Which is why I want to introduce a tried-and-true options strategy for volatile times, much like what we have experienced throughout most of 2022. The buyer of options earns larger profits from each winning trade, but he wins less frequently. Traders lose money because they try to hold the option too close to expiry. Normally, you will find that the loss of time value becomes very rapid when the date of expiry is approaching. Hence if you are getting a good price, it is better to exit at a profit when there is still time value left in the option. “Profit Parabolic” trading strategy based on a Moving Average.

What is the safest option strategy?

The call option is “covered” by the underlying shares, which limits potential losses. This is a relatively safe strategy because the potential downside is limited to the price of the underlying shares. The bear call spread is one of the two-leg bearish market guaranteed options trading strategies. In this approach, 1 OTM Call option with a higher strike price is purchased, and 1 ITM Call option with a lower strike price is sold.

The moving averages also work well as filters, telling fast-fingered market players when risk is too high for intraday entries. I explored the reasons for failure at options trading and narrowed it down to two main reasons; 1. Lack of a proven and systematic approach which novices to finance and economics can follow and trade with.

If the stock prices rise above the threshold point, intraday traders consider entering long positions and buying shares. An example is to buy 7 XOM Nov 80 calls and sell 7 XOM Oct 75 calls. Alternatively, you can buy 7 XOM Nov 60 puts and sell 7 XOM Oct 65 puts. When you possess both positions at the same time, it’s a double diagonal spread which is thus one of the best options strategies for income.

A sideways market is one where prices don’t change much over time, making it a low-volatility environment. For example, suppose an investor buys 100 shares of stock and buys one put option simultaneously. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. The best options strategy for income is the cash flow investing strategy which involves the selling of options.

Important Links:

Tags:

Courses

-

MBA for Executives

-

testssd

-

testssd

-

testssd

-

testssd

-

testssd

-

BBA from UK University

-

Banking course + Job

-

MBA from ARU, Anglia Ruskin University (UK)

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

MBA from HSNC University (Mumbai, India)

-

Sage Foundation - Professional Diploma in Banking

-

3-in-1-management-program

-

Post Graduate Diploma in Banking & Finance

-

Post Graduate Diploma in Digital Marketing

-

Post Graduate Diploma in Integrated Marketing, Advertising & Communication

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

Professional Diploma in Digital Marketing

-

Professional Diploma in Real Estate Management

-

Professional Diploma in Photography

-

Certificate in Business English