Search

What is the Fugitive Economic Offenders Bill 2017?

March 06, 2018

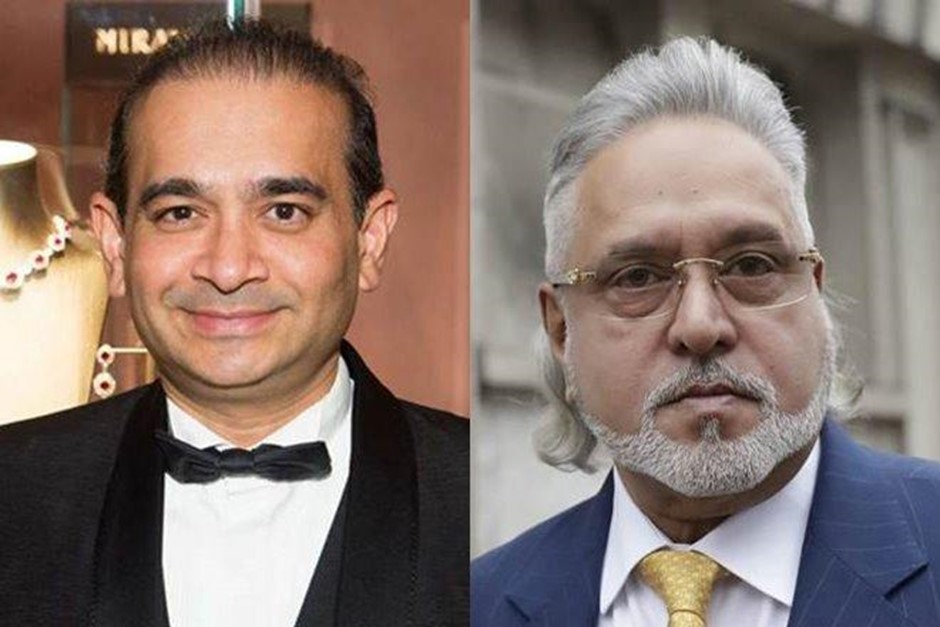

After the airline tycoon Vijay Mallya fleeing from the country to avoid arrest for economic fraud, and now “jewel-thief” Nirav Modi who left the nation after successfully scamming Rs. 12,700 crores, the union cabinet has finally given a nod to a major reform to handle such problems in the form of Fugitive Economic Offenders Bill, 2017.

What is the Fugitive Economic Offenders Bill?

The Fugitive Economic Offenders Bill was drafted to help the government and investigation agencies deal with the economic offenders who have left the country to avoid the investigative process. It was approved by the union cabinet recently and will be implemented soon.

The bill will allow the government to confiscate the properties of the economic offenders who have committed frauds amounting to Rs. 100 crores or more. These frauds are defined under the Customs Act, the Indian Penal Code, Insolvency and Bankruptcy Code, Limited Liability Partnership Act, the SEBI Act, and the Prevention of Corruption Act.

Who is a “fugitive economic offender”? How will they be dealt with the new Bill?

A fugitive economic offender is a person against whom a warrant has been issued, who has either left the country to avoid prosecution or is already outside the country but refuses to come back to face the prosecution.

As per the Bill, when a person is identified as a fugitive economic offender, the court will issue a warrant against them asking them to present themselves within 6 weeks. If they fail in doing so, they will be declared a fugitive economic offender and their properties will be seized. Moreover, they (the offender) can’t file or defend a civil claim in the country as per Section 11 of the Act.

Once the properties are seized, the court will appoint an administrator to manage and dispose of them for fulfilling the creditors’ claims.

Important Links:

Courses

-

MBA for Executives

-

testssd

-

testssd

-

testssd

-

testssd

-

testssd

-

BBA from UK University

-

Banking course + Job

-

MBA from ARU, Anglia Ruskin University (UK)

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

MBA from HSNC University (Mumbai, India)

-

Sage Foundation - Professional Diploma in Banking

-

3-in-1-management-program

-

Post Graduate Diploma in Banking & Finance

-

Post Graduate Diploma in Digital Marketing

-

Post Graduate Diploma in Integrated Marketing, Advertising & Communication

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

Professional Diploma in Digital Marketing

-

Professional Diploma in Real Estate Management

-

Professional Diploma in Photography

-

Certificate in Business English