Search

What are the Different types of Cheques in India?

November 07, 2017

A cheque is a financial instrument which can be easily transferred to another person through endorsement. Due to its simplicity, it’s still one of the popular methods of payment in India.

A lot of people don’t know this, but a cheque can be of various types. The following are some of the most common ones:

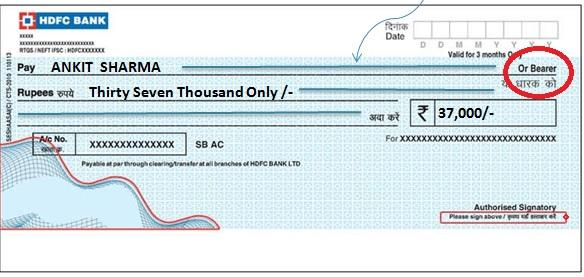

Bearer Cheque

Bearer cheques can be identified by the word “Bearer” marked on the top-right corner of the cheque (as shown in the image above). Any person who has a bearer cheque can withdraw the amount, which makes it risky. This is why usually people use order cheques or crossed cheques.

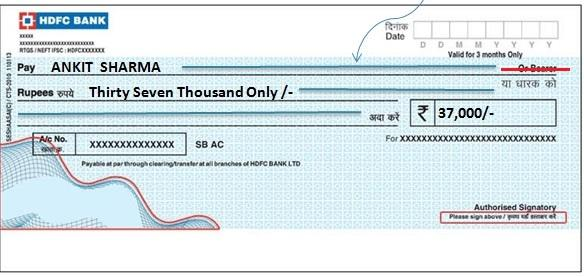

Order Cheque

When the words “or Bearer” printed on the cheque are struck out and the word ‘order’ may be written on the cheque, it’s called an order cheque. The advantage of this is that now only the person whose name is written on the cheque can withdraw the cheque amount.

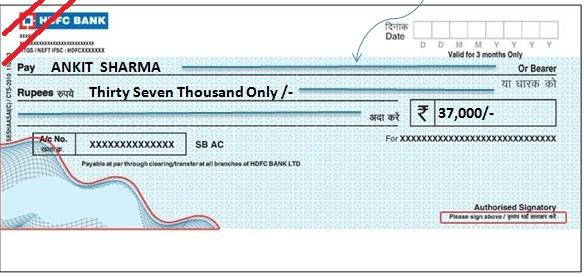

Crossed Cheque

You can make a bearer cheque a crossed cheque by marking two parallel lines on the top left corner of the cheque (as shown in the image above). In doing so, you specify that the cheque can’t be encashed at the cash counter of a bank but can only be credited to the payee’s bank account.

Anti-Dated and Post-Dated Cheque

A cheque in which the drawer mentions a date earlier than the date at which it is presented to the bank, it is called as anti-dated cheque. Similarly, if it mentions a date that’s yet to come, is called post-dated cheque.

Mutilated Cheque

A cheque that’s torn at some places is called a mutilated cheque. Money can be withdrawn with such a cheque only if the damage is marginal and the critical information such as the name of the payee, amount, MICR line, and the signature are clearly visible.

Important Links:

Tags:

FinanceCourses

-

MBA for Executives

-

testssd

-

testssd

-

testssd

-

testssd

-

testssd

-

BBA from UK University

-

Banking course + Job

-

MBA from ARU, Anglia Ruskin University (UK)

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

MBA from HSNC University (Mumbai, India)

-

Sage Foundation - Professional Diploma in Banking

-

3-in-1-management-program

-

Post Graduate Diploma in Banking & Finance

-

Post Graduate Diploma in Digital Marketing

-

Post Graduate Diploma in Integrated Marketing, Advertising & Communication

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

Professional Diploma in Digital Marketing

-

Professional Diploma in Real Estate Management

-

Professional Diploma in Photography

-

Certificate in Business English