Search

Connect Amazon Seller Central with QuickBooks Commerce

October 04, 2021

Contents:

Proper bookkeeping helps you track expenses, manage cash, and keep a record of all transactions for tax preparation. Want to improve your cash flow and get more confident with your numbers? Learn how to use Xero effectively for your e-commerce business with our free Xero toolkit.

- The AMZ Bookkeeper team is well-trained in handling eCommerce business accounts offering you a free consultation to understand your needs before designing a customized package of services.

- If you choose to hire an accountant, you will spend anywhere from $1,000 to $5,000+ per year, not including the cost of software .

- If you have the additional budget, you can hire a professional to assist you with your bookkeeping.

- The deposit is net of all these activities on the date of receipt.

Our transparent flat tax preparation rates ensure you don’t have any surprises. Investing activities involve buying and selling assets that are not related to the inventory. Fulfillment By Merchant sellers would need to include the purchase of equipment and property as outflows on their cash statement. My first observation is that my expenses growth didn’t exceed revenue growth. Earlier, when we saw that revenue grew by ~35% from June to July, a little hazard light went off in my head, and I was worried that my advertising costs might have spiraled out of control.

Accounting Tips & Tricks

For aspiring entrepreneurs and growing businesses, ecommerce can be a profitable model to adapt either as the sole focus of your business or as an additional selling channel. At tax time, you’ll need to prove your expenses are valid, so figuring out the proper storage for all of your financial records will be crucial. Record the details of each financial transaction on a regular basis—you might consider scheduling a set time for bookkeeping to keep yourself on track. Remember, organization is the key to a fast, clean bookkeeping process every month.

Not only will this assist you in your bookkeeping, but it will help you set more accurate prices to cover the entire cost of goods. Cloud-based software is similar to many storage platforms you might use, like Dropbox or Google Drive. However, thesecloud bookkeeping servicesare designed specifically for bookkeeping and accounting.

Top 20 Best Accounting And Bookkeeping Apps In India 2023 – Inventiva

Top 20 Best Accounting And Bookkeeping Apps In India 2023.

Posted: Wed, 15 Feb 2023 08:00:00 GMT [source]

We can prepare your federal and state tax returns quickly and easily with our streamlined client portal and 100% digital process. We know what questions to ask and what data to request without you needing to explain your business to us. You won’t have to worry about us missing any deductions that apply especially to e-commerce businesses.

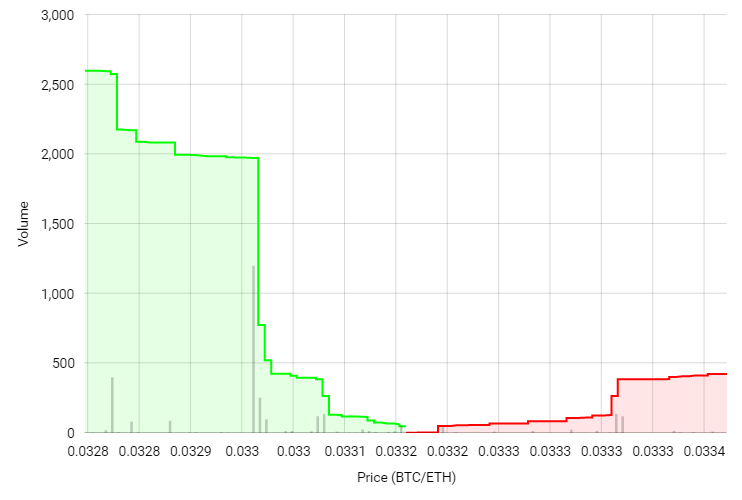

To check your daily sales and keep an eye on your profit margin:

Accrual accounting – records transactions when they occur. Integration of professional experts can make streamline the whole accounting process. We understand that not every business owner is adept in the financial aspects of running a company. Ebiz Accounting believes that it is in the best interests of the client to fully understand how to interpret and utilize the information provided. With the personalized attention you deserve, we can help you navigate your business towards success.

Nearly Half of Accounting Firms Outsource Client Accounting … – PR Web

Nearly Half of Accounting Firms Outsource Client Accounting ….

Posted: Tue, 07 Jun 2022 07:00:00 GMT [source]

Your debit memo is a list of categories your business can use to differentiate your financial transactions. It offers an overview of every area of your business that spends or makes money. Tax deductions are business-related expenses you’ve made over the year that you can subtract from your tax bill. There are many tax deductions specific to ecommerce, but you can’t use them if you don’t organize your expenses. You find the net profit by taking your total sales income and subtracting the money you spent to make those sales like shipping, storage, and purchase fees. When your books are up-to-date, you’ll have this number at hand at all times.

Amazon Accountant Bookkeeping

These are difficult to discern without the kind of https://1investing.in/ reporting that an accountant can provide you with . We can also handle income tax return preparation, payroll, or preparation of 1099s for independent contractors to make our services a one-stop shop for all your tax and accounting needs. To categorize inventory properly and keep a real-time balance sheet, you can then make decisions from data instead of just your gut feeling.

Reconciliation reports can also help protect your company from fraud. If your VA has access to your bank accounts, running a reconciliation report will help ensure your VA is not stealing from your company. It would be best if you kept up with categorizing your transaction on a weekly or monthly basis. Then you will have categories that are defined and show where you are spending your money. At least once per quarter, it would be best if you created a cash flow forecast.

For example, you might see that there was a surge in new sales in June. With the P&L statement, you will be able to dig in and see what caused that surge. Maybe the company spend more money on PPC ads, tried a new SEO strategy, or something else entirely.

File your taxes, you’ll need to report your income and expenses, but if they’re not classified correctly, you may be missing out on huge savings or may even incur a penalty. You’ll also want to have your financial records on hand in the event that you are audited by the IRS. Everything we’ve covered thus far has been bookkeeping.

There are tons of nuances around payroll taxes, and it is one of the few things – along with student loans – that can be discharged even if you file bankruptcy. Unless you have an extremely tight budget or extensive financial experience, accounting and bookkeeping is usually one of the first things entrepreneurs outsource or delegate. As the owner, you are pulled in many directions from sales and marketing to sourcing new products, supply-chain management, customer service, and accounting and bookkeeping. If you’ve worked with a DIY accounting software program like QuickBooks, you know that these products can help you manage more complex financial situations than a simple spreadsheet . However, as your business grows, you may start to come up against their limitations.

- New businesses and startups looking for easy-to-use software which does not require an accounting background can find several entry-level appropriate systems to meet all their needs.

- Learn how to use Xero effectively for your e-commerce business with our free Xero toolkit.

- The P&L statement gave me the information that I needed to make a decision about the future of this product.

- When your books are up-to-date, you’ll have this number at hand at all times.

Then, either you have to fix them or you have to pay extra money to your accountant to clean up your VA’s work at tax time. Having the right accounting and bookkeeping systems and processes in place can give you confidence in your numbers and help you make better decisions about your business. When you know your numbers, this allows you to see what’s working, capitalize on any early trends, and grow your business. You might think of it as just a routine business activity. No business can prosper without finance, it’s like blood for any business enterprise. It calls for essential financial management, which is not possible without accounting.

Buyers Remorse Returns Drove This Seller from eBay – EcommerceBytes

Buyers Remorse Returns Drove This Seller from eBay.

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

Now that you know your COGS from your operating expenses, you must track them both. They’re the payments you make so you can operate your business. COGS is all about building a product so that you can sell it.

But you need strong accounting to GROW your business and your wealth. Net profit is what the IRS will tax you or your business on, not revenue. Let me give you a few more examples of business expenses that you should track so you can lower your tax liability.

Important Links:

Tags:

Courses

-

MBA for Executives

-

testssd

-

testssd

-

testssd

-

testssd

-

testssd

-

BBA from UK University

-

Banking course + Job

-

MBA from ARU, Anglia Ruskin University (UK)

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

MBA from HSNC University (Mumbai, India)

-

Sage Foundation - Professional Diploma in Banking

-

3-in-1-management-program

-

Post Graduate Diploma in Banking & Finance

-

Post Graduate Diploma in Digital Marketing

-

Post Graduate Diploma in Integrated Marketing, Advertising & Communication

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

Professional Diploma in Digital Marketing

-

Professional Diploma in Real Estate Management

-

Professional Diploma in Photography

-

Certificate in Business English