Search

10 Things Every Sole Trader Should Know About Bookkeeping Sole Trader Bookkeeping

July 28, 2021

A sole trader also must register for VAT if they have a turnover above £85,000 or want to reclaim VAT on sales made to VAT-registered businesses. According to 81 percent of CBs who interviewed for a new job after becoming certified, having a certification contributed to getting the interview 4. With a certified https://x.com/BooksTimeInc bookkeeper designation, you are qualified to perform all critical functions through the adjusted trial balance and basic payroll for small to medium-sized businesses. You can learn bookkeeping for free and at a low cost through online courses. These courses focus on bookkeeping fundamentals to help improve bookkeeping knowledge and skills.

- Maintaining accurate records is crucial for several reasons, including avoiding human error and fulfilling legal requirements for record retention.

- Both the CPB and CB certifications require similar eligibility requirements.

- Retain all profits – The sole trader retains all net business income and does not share profits with others besides paying taxes.

- You will learn how to record costs, value inventory, calculate depreciation, analyze financial statements, and use software programs.

- So, if you raise an invoice to a customer on the 15th, this is the date the income is recorded, regardless of when they pay it.

Open a separate bank account for your business

So, starting now will give you plenty of time to get used to the process before it becomes mandatory. From April 2026, the government will introduce Making Tax Digital for Income Tax Self Assessment, where accounting must be done using cloud-based software. You can create also quotes and invoices, customised with your branding and full contact details, which can be emailed to customers in PDF format. Or you can spot someone who hasn’t paid their invoice on time and gently suggest that you can’t do anymore work until you’re all square. It’s one of those jobs you’ll thank yourself for later as your business grows and there are more and more transactions happening relating to the business. You can opt for the standard VAT scheme or Flat Rate VAT, which was set up to help reduce the admin load for smaller businesses.

AccountingWEB Live: what to expect from IRIS

Bookkeepers also deposit money, cash https://www.bookstime.com/ checks, and ensure correct credit card transactions. Your job as a bookkeeper entails systematically keeping track of an organization’s financial transactions. For the information to be reported as a financial statement, it needs to be identified, accepted, classified, and recorded. Learn more about bookkeeping, how it differs from accounting, the required qualifications, and bookkeeping jobs and salaries.

Should you use accounting software?

One way to stay on top of cash flow is through creating accurate and detailed cash flow projections. These projections allow you to anticipate any future financial requirements and adjust your business accordingly. In addition to tracking inventory levels, you should also monitor assets such as equipment and vehicles used for business purposes.

Navigating VAT and HMRC Regulations

To reconcile your bank account, start by importing bank transactions into your bookkeeping software. Then, compare the imported transactions with those in your bookkeeping records to ensure they match. As a sole trader, you have complete control over your business’s finances.

- Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals.

- Expenses are something that, big or small, every business needs to deal with at some point.

- If you’re thinking about setting up on your own and haven’t already registered as a sole trader with HMRC, you can find out how to set up as a sole trader here.

- You need to get into the habit of chasing invoices early to make sure you have plenty of money to cover your business costs.

- The Australian Taxation Office (ATO) offers a range of information and tools that can help you understand your obligations and stay compliant with the law.

Both the CPB and CB certifications require similar eligibility requirements. You can earn either certification by passing a four-part multiple-choice exam, agreeing to abide by a professional code of conduct, and verifying your bookkeeping accounting education and experience. Bookkeepers play a vital role in the business accounting cycle by collecting and inputting data. As a detail-oriented professional, you would play a crucial role in the organization and growth of companies from small businesses to major corporations. In researching bookkeeping or bookkeeping accounting, you may come across information on bookkeeping for sole traders accounting or find that bookkeeping and accounting are used interchangeably. While there is some overlap between bookkeeping and accounting, several factors distinguish these processes, as we explore in the table below.

Create financial reports.

- In some cases, customers can’t or won’t pay their invoices, leaving you with bad debt.

- This means that if you make purchases on credit, make sure you have all the invoices from the vendor.

- This will govern how you pay taxes as a small-business owner, but also what kind of liability protection you have in case something goes wrong and how you’ll structure your business.

- If you are a sole trader working from home then, you need to note down that some of your home expenditure may also be tax-deductible.

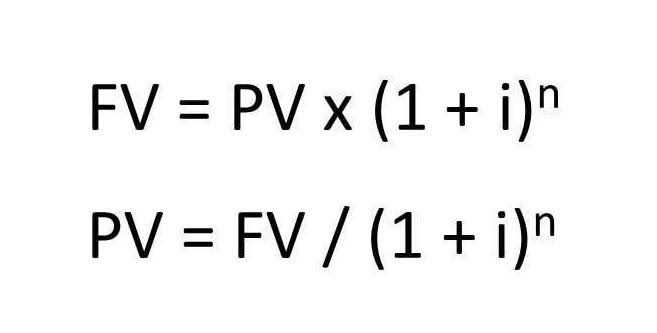

- So you have two accounting methods to choose from- traditional accounting method (called also accrual accounting) and cash-basis accounting.

Sole traders should seek a bookkeeping system that is good with monthly records. Bookkeeping requirements are much lower than that at a private or public limited company, so there is no need to overcompensate. In the grand scheme of things, MTD will make things much easier for sole traders. Bear in mind that MTD for ITSA will only affect sole traders who make more than £50,000 per year. With Making Tax Digital (MTD) rolling out, it’s advisable to get used to a digital system. It’s also much easier to keep all of your records organised when they’re on an accounting software.

Important Links:

Tags:

Courses

-

MBA for Executives

-

testssd

-

testssd

-

testssd

-

testssd

-

testssd

-

BBA from UK University

-

Banking course + Job

-

MBA from ARU, Anglia Ruskin University (UK)

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

MBA from HSNC University (Mumbai, India)

-

Sage Foundation - Professional Diploma in Banking

-

3-in-1-management-program

-

Post Graduate Diploma in Banking & Finance

-

Post Graduate Diploma in Digital Marketing

-

Post Graduate Diploma in Integrated Marketing, Advertising & Communication

-

4-IN-1 Professional Diploma in Banking, Financial Services & Insurance (PDBFSI)

-

Professional Diploma in Digital Marketing

-

Professional Diploma in Real Estate Management

-

Professional Diploma in Photography

-

Certificate in Business English